On February 14, the Japanese operator Rakuten Mobile released its 2021 annual financial report, revealing a lot of key information that had not been disclosed before. This star operator once again attracted the attention of the industry.

Build the world's largest OpenRAN network

As a wireless engineer who has been concerned about base station equipment for a long time, the first thing that catches our attention is the following picture.

Rakuten said that it has deployed the world's largest OpenRAN network, with more than 200,000 cells (RU units), and the site types include outdoor 4G macro sites, outdoor 4G small cells, indoor 4G small cells and outdoor 5G macro sites. Number of deployments for each type of device.

The operator also said that its 4G population coverage rate has now completed the target set by the Ministry of Internal Affairs and Communications four years ahead of schedule, reaching 96%, but declined to disclose the 5G population coverage rate.

| Secen | Site Type | Manufacturer | Quantity |

| 4G Outdoor | Macro | NOKIA | 62156 |

| Macro | KMW | 29002 | |

| Mini Macro | Airspan | 532 | |

| Small Cell | Airspan | 2418 | |

| 4G Indoor | Enterprise Small Cell | Sercomm | 55052 |

| Femto | Sercomm | 52742 | |

| 5G Outdoor | 5G mmW DRU | Airspan%Qualcomm | 4328 |

| 5G Sub6 RU | NEC | 3092 | |

| TOTAL | 209322 | ||

Comparing the above data, Rakuten Mobile has deployed about 90,000 4G outdoor macro cells, while only 7,420 5G outdoor macro cells. It can be seen that although its 4G network has been basically completed, the construction speed of 5G network is very slow, which is not difficult to understand. The reason for the disclosure of 5G population coverage.

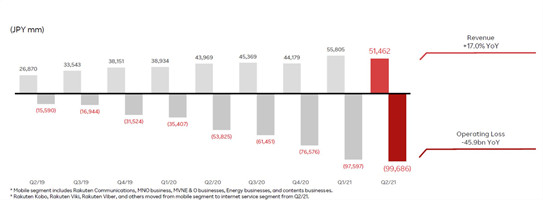

Losses hit record high

The financial report shows that since 2019, the sales revenue of Lotte Group has risen year by year, and the annual sales revenue in 2021 will reach 1,682 billion yen, a year-on-year increase of 15.5%.

However, profits continued to grow negatively, and in 2021, it suffered the largest loss in history, with a loss of 225 billion yen for the whole year.

Judging from the financial report data, the performance of Rakuten Group's e-commerce, financial technology and other business sectors has performed well, but its mobile business (Rakuten Mobile) has seriously dragged its feet, which is the reason for the continuous loss of the group.

Due to continuous investment in mobile networks and base stations, as well as high roaming costs (renting KDDI networks in some areas), Rakuten Mobile's losses have continued to expand since 2019, reaching a new high in 2021, with losses reaching 421.1 billion yen.

The financial report also revealed that since Q1 2018, Rakuten Mobile has invested more than 1 trillion yen in fixed assets in the mobile network field.

Remember that Rakuten Mobile once stated that its single-site investment cost based on the OpenRAN architecture is 40% lower than that of traditional operators. From the rough estimation of the above investment amount and the scale of the built network, I feel that it is not as economical as claimed.

The 1 trillion yen investment also exceeded Rakuten Mobile's expectations.

I remember that when Rakuten announced its entry into mobile operators in 2019, it said that it would raise about 600 billion yen to build a nationwide LTE network by 2025, of which 300 billion yen was invested in outdoor base stations, 80 billion in indoor base stations, and 80 billion in indoor base stations. 220.4 billion investment in network, transmission network, and later expansion.

At that time, the industry generally believed that the investment was "too little", and it was only the investment amount of NTT DoCoMo for one year, but Rakuten believed that due to its small spectrum resources (only 20MHz), few users, and a pure LTE network (without 3G services), "600 billion yen is enough to build a nationwide network". It seems that it was still too "naive" back then.

User growth is slow

As a new operator, Rakuten Mobile has been using a strategy of ultra-low prices, but Japanese consumers seem to be reluctant to pay for low prices.

The financial report shows that since April 2020, the number of Rakuten Mobile users has maintained steady growth. As of February 2022, the total number of Rakuten Mobile users (including MNO and MVNO contracts) has exceeded 5.5 million.

Despite the "steady growth", comparing the market share of Japanese mobile operators, NTT DoCoMo has about 84 million mobile subscribers, au about 61 million, and Softbank about 48 million. Obviously, although Rakuten Mobile is subversive enough on the Internet, it is not in the market. The scale does not pose much threat to traditional operators.

Some analysts said that in order for Rakuten Mobile to break even, it needs to develop to at least 20 million users. From 5 million to 20 million, according to the current user development speed, the road ahead for Rakuten Mobile is still very long.